Tap Bonds: India’s First AI-Powered Bonds Research and Analysis Platform

Bengaluru, February 27, 2025 – Tap has launched Tap Bonds, India’s first AI-powered platform for bonds research and analysis. The platform targets the growing base of bond investors in India and offers tools such as screeners, summarizers, and payout trackers. Tap Bonds is designed to provide investors with a comprehensive suite of resources for informed…

Finuit’s Bank Statement Analyzer simplifies processing of MSME Loan Applications

There are over 6.3 million MSMEs in India, with an unmet credit demand of close to 120 billion USD. Access to small ticket loans for MSMEs is often a long, uncertain process. MSME lending landscape faces challenges of credit underwriting necessary for the approval and disbursal of loans. Credit underwriting requires the applicant’s financial data…

4 AI-Powered Bank Statement Analyzers for MSME Lending

India has over 6.3 milion MSMEs, with an unmet credit gap of 120 billion USD. According to 2024 Trans Union CIBIL report, only 2.5 million MSMEs have access to formal credit. MSMEs have a high demand for loans under 1 Lakh also known as small ticket loans. The lending process for such loans is often…

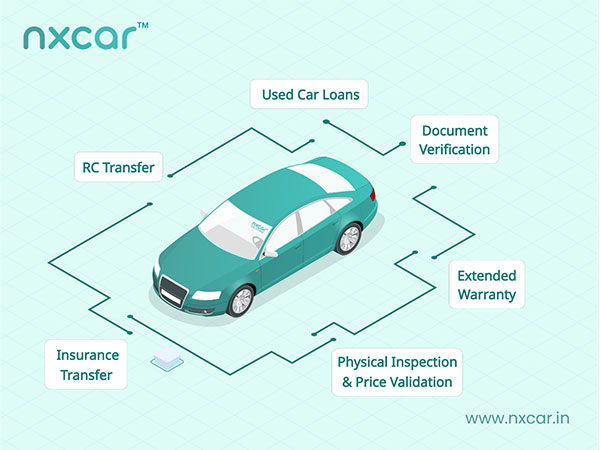

Nxcar Leads Auto Fintech Innovation as the First Company to Introduce Loans for Peer-to-Peer Used Car Transactions

Gurgaon-based automotive fintech company, Nxcar, has launched an integrated platform for pre-owned car transactions in India. For the first time, individual customers can access loans, vehicle inspection, valuation, insurance, and RC transfer services, whether they are purchasing second-hand cars from individual sellers, dealers, or classified listings. With 7.2 million cars expected to be sold in 2024,…

NKGSB Co-operative Bank to have a new Corporate Building at MIDC Andheri ( E )

Seen in the photograph H. H. Shreemad Shivanand Saraswati, Peethadish Kavale Math, Chairperson CA Himangee Nadkarni, Vice Chairman CA Shantesh Warty, Members of the Board of Directors & Board of Management, Senior Executives of the Bank and other dignitaries. NKGSB Co-op Bank having a legacy of 106 years is a leading Multi-State Scheduled Co-operative Bank…